Service Contractors: Grow like a software startup

Every Sunday evening I receive an email from the software investment banking team at Key Bank Capital Markets. The subject line of the email is “Software Valuations,” and the email contains a link to a weekly report that details the valuation metrics of about 100 different software companies. All of these companies are public corporations, so their stock information is readily available for the folks at Key Bank to analyze. Most of the companies they follow are software as a service (SaaS) companies, and because ServiceTrade is a SaaS company, this report is very interesting to me as the CEO and a shareholder of ServiceTrade. It is my job to maximize the value of our stock for the benefit of all of our shareholders, and the Key Bank team helps me do this through their analysis of SaaS company valuations.

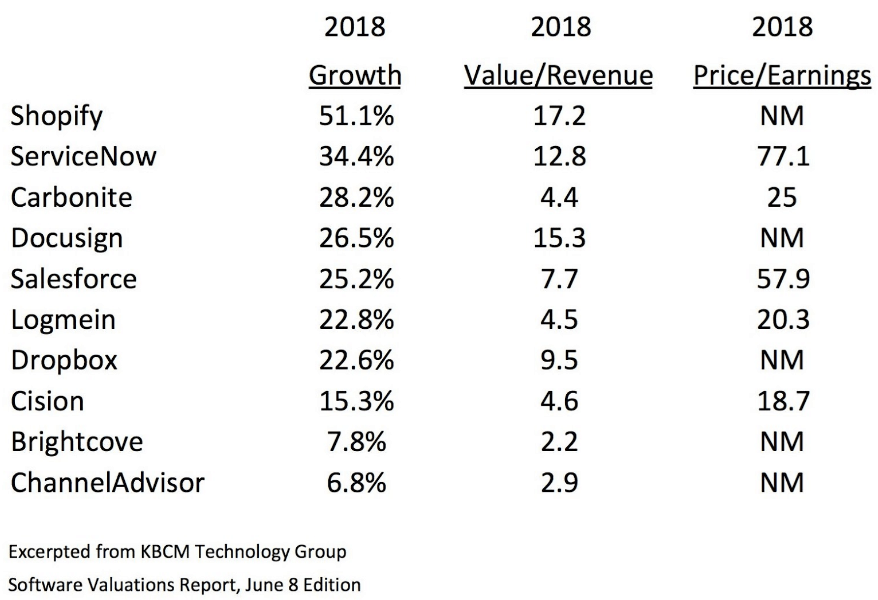

Here is an annotated version of a table they publish for about 70 different SaaS companies. I limited the table to 10 of the entries to make a point about the importance of growth to shareholder value.

I sorted these from high to low based on the value-to-revenue multiple. The value-to-revenue multiple indicates how much the total of each company’s outstanding stock is worth as a multiple of their anticipated 2018 revenue. The number-one performer is Shopify, with a value-to-revenue multiple of 17.2X. The total value of all outstanding Shopify stock is equal to 17.2 times the revenue expectation for Shopify in 2018. You are reading that correctly. Investors are willing to buy Shopify stock at an extraordinary premium because they believe Shopify is going to grow, grow, grow. And Shopify is delivering on that promise. Note that Shopify expects to grow revenue by 51.1 percent in 2018 compared to their revenue in 2017. That’s a terrific growth rate. Also note that Shopify has a value of NM (Not Measured because they are not making a profit) in the category of price-to-earnings. That’s because Shopify is going to lose money in 2018. They will probably also lose money in 2019 and 2020 because they are investing like crazy to continue to grow. Despite this lack of profit, their stock is still extremely valuable.

I sorted these from high to low based on the value-to-revenue multiple. The value-to-revenue multiple indicates how much the total of each company’s outstanding stock is worth as a multiple of their anticipated 2018 revenue. The number-one performer is Shopify, with a value-to-revenue multiple of 17.2X. The total value of all outstanding Shopify stock is equal to 17.2 times the revenue expectation for Shopify in 2018. You are reading that correctly. Investors are willing to buy Shopify stock at an extraordinary premium because they believe Shopify is going to grow, grow, grow. And Shopify is delivering on that promise. Note that Shopify expects to grow revenue by 51.1 percent in 2018 compared to their revenue in 2017. That’s a terrific growth rate. Also note that Shopify has a value of NM (Not Measured because they are not making a profit) in the category of price-to-earnings. That’s because Shopify is going to lose money in 2018. They will probably also lose money in 2019 and 2020 because they are investing like crazy to continue to grow. Despite this lack of profit, their stock is still extremely valuable.

Contrast Shopify with ChannelAdvisor. Their stock trades for just 2.9 times the revenue expectation for 2018. It’s interesting that Shopify and ChannelAdvisor offer a similar value proposition with their software applications – they both help small merchants sell their products online. The biggest difference is that Shopify is expected to grow 51.1 percent in 2018 and ChannelAdvisor is expected to grow only 6.8 percent. The expectation of growth explains why Shopify is almost six times more valuable than ChannelAdvisor.

Why is any of this relevant to your business? It is very relevant because their business model is similar to yours in that they sell a subscription program to their customers. If you are following my advice and developing a subscription program for maintenance, monitoring, and inspections for which you sell an annual or longer contract, your business is similar to these companies, and investors will ultimately value your business in the same way they value these businesses. The point I am trying to make is that growing is better than grinding when it comes to creating value for shareholders.

Grinding means pushing everyone in the organization to squeeze more profit from the current revenue stream. I have nothing against profit, and I think you should aim to be profitable. But grinding does not significantly increase the value of your business if there is the possibility to grow the business instead.

Growing is much more fun for everyone than grinding, for all of the obvious reasons. Growing means that new stuff is happening all the time. New products are being introduced to the market. New customers are being served. New employees are joining the company to help take care of the new customers. New promotions are being handed out because there is more responsibility to be shared. New offices are being opened. New equipment is being purchased. New tools are being deployed. New training is underway on how to use new tools. New, new, new means fun, fun, fun.

Grinding sucks because old tools are breaking and not being replaced. Old employees are leaving and not being replaced or taking on more responsibility for no increase in pay. Old customers are complaining because they are not getting good service. Old trucks are breaking down and disrupting the workday. Old, old, old means suck, suck, suck.

What is your plan for growth? How are you going to orient your company in a direction that gets to the fun of growing? It begins with a commitment to growth. If there is no expectation in the company that growth is an important metric, then no growth will occur. Set growth targets as part of your planning process, and don’t be shy about asking people to stretch to achieve something ambitious. For organic growth, plan to grow by 10 percent per year, and think about pushing for 20 to 30 percent (depending on the size of your company). All the best employees in your business will rally around the growth goal because none of them signed on for a career in which not much was achieved. Your employees will get much more career development from an aggressive growth strategy.

Maximizing the value of your business is the most tangible outcome associated with a successful growth strategy. The difference in valuation of the companies tracked by Key Bank in the SaaS market based on their respective growth rates is extravagant, and it should be a lesson for anyone who wants to build value with a subscription business model. The intangible value of having a growth strategy is that you will attract, develop, and retain a better class of employees who value your company because they expect to experience greater career development. They will be exposed to ever-increasing levels of responsibility, which leads to higher job satisfaction and better retention. Growing is fun and grinding sucks, so aim for growth and get more pay and have more fun along the way.

Billy Marshall explores how Fire Protection contractors can boost growth and productivity with technology in this recording of Off the Record with Paul Giannamore filmed at the NFPA Conference. Billy Marshall, founder of ServiceTrade, understands the business of commercial service for fire protection equipment, which is why he founded Service Trade—a platform designed to help contractors streamline inspections, […]

In the fire protection industry, inspections are more than a compliance checkbox—they’re the gateway to stronger customer relationships, more predictable revenue, and a more efficient service operation. But for too long, inspections have been riddled with delays and disruptions, fragmented systems, and manual processes that limit your team’s productivity and profitability. That’s why we built […]