Sales Tax Exemption Best Practices with ServiceTrade

Bringing on board a new client is exciting news! However, if they qualify for tax exemption, you’ll need to have everything in place to handle their invoices correctly, considering their specific location, products, and services.

Incorrectly applying sales tax to an exempt transaction can lead to dissatisfaction and the unnecessary effort of issuing a tax refund. Similarly, neglecting to charge sales tax on a taxable sale or lacking a proper exemption certificate means you’ll be liable for the tax. If your sales process involves several departments, establish a clear protocol for collecting exemption certificates for every new exempt client.

It’s crucial to secure a valid exemption certificate at the point of sale or before completing the order. Failure to do so may lead to delays in processing the order or increase the likelihood of being audited.

According to our partner, Avalara, your procedure for collecting these documents should feature:

- A straightforward method for clients to provide their exemption certificate.

- Confirmation that the certificate is legitimate, correctly completed, and relevant to the purchase.

- A system for storing the certificates securely and where they can be easily retrieved.

- Handling exemption documents.

Developing a dependable method for the collection and storage of exemption certificates is essential, but you must also ensure they are kept up to date. (This can be tricky. Certificates might have a validity of one year, three years, or might not expire at all.)

Preparing for Tax Audits

Facing an audit is inevitable; it’s only a matter of time. For auditors, focusing on exemption certificates is a straightforward target. If required to present these certificates for exempt transactions, how smoothly can you access them? Lengthy audits can become a significant inconvenience for your company.

Designing your exemption certificate process with potential audits in mind is vital. Opt for a secure, centralized database that allows designated staff to easily access reports or locate specific records, minimizing audit disruptions. Even more effective is implementing a digital database with a portal for auditors, enabling them to independently access the information they need.

Best practices in ServiceTrade for tracking tax exempt status

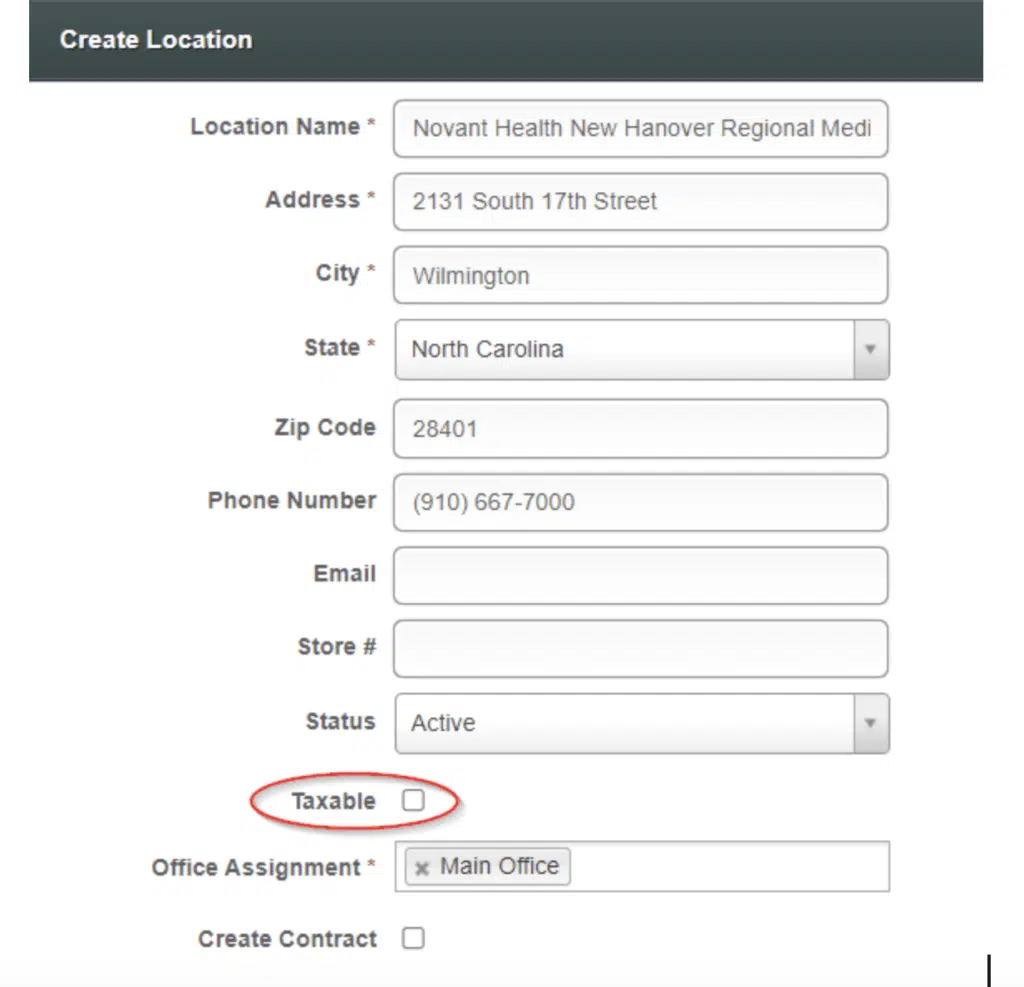

Note the customer’s location is not taxable.

Attach Tax exemption certificate to location record for easy access.

Add a tag for further reminder.

Note: Thanks to Avalara for their expertise. You can read more about sales tax exemption on the Avalara blog.

STOP TYPING. Start Scanning. Technicians have always done whatever it takes to get the job done, but manual asset entry has never been the part they enjoy. Between faded serial plates, tiny lettering, and tight schedules, capturing equipment details by hand slowed everyone down. And when the data wasn’t complete or accurate, the office was […]

You’ve invested in software. You’ve digitized processes. You’ve built dashboards. Yet somehow, your team still asks, “Whose numbers are right?” You’re not alone. Many commercial service contractors invest heavily in data tools only to see minimal ROI. The problem usually isn’t the technology—it’s one of these five critical failures. Failure #1: Skipping Stages The mistake: […]