The Hidden Cost of Broken Accounting Integrations

Broken accounting integrations aren’t just a minor inconvenience, it’s a business-critical problem that’s costing contractors real money every single day.

When a finance manager at a contracting company described their current system, they didn’t mince words: “We’ve got four entries that occur on that transfer, which, if you’ve ever run an invoicing report, is a nightmare to navigate.”

The Real Cost of Integration Failures

Most contractors focus on the obvious costs of poor software integration: the extra time spent on data entry, the billing errors, the reconciliation headaches. But the hidden costs are even more damaging: delayed financial decisions, misinformed purchasing, and lost revenue opportunities.

As one contractor put it: “There are two things that run your business: your accounting and your sales. Any amount of time without updated information is downtime for me in making good business decisions.”

Every hour your team spends manually reconciling data between systems is an hour not spent generating revenue. Every delayed report means delayed decisions. Every integration error creates doubt about your data’s accuracy.

The Administrative Time Drain

The numbers don’t lie. Contractors who’ve implemented ServiceTrade’s QuickBooks integration report cutting their billing cycle time in half. That’s not just efficiency, that’s accelerated cash flow and freed-up capacity for growth.

But many are still stuck in what we call the “reconciliation trap.” Running constant reports between their field service platform and QuickBooks, chasing down where the disconnects happened, and wasting hours every week.

The “Four Entries” Problem

Here’s what broken integrations often look like in practice:

- A purchase order doesn’t sync to QuickBooks until the product is received.

- The system creates an inventory adjustment, then adds it back in.

- It generates a sales receipt.

- Finally, a manual “issue” step is required to remove the inventory.

What should have been a single clean transaction balloons into four separate entries, multiplied across hundreds of transactions each month. The result? An inventory reporting nightmare that makes accurate decisions nearly impossible.

Why This Matters More Than You Think

Poor integration doesn’t just add extra work, it creates doubt. If you can’t trust your reports, you can’t confidently purchase materials, forecast revenue, or identify your most profitable services.

Beyond the Obvious: Hidden Opportunity Costs

The most expensive part of broken integrations isn’t the admin time, it’s the missed opportunities. One project manager summed it up: “The time we spend manually fixing things is preventing us from getting ahead on potential opportunities. It hasn’t done us any favors.”

The Customer Experience Impact

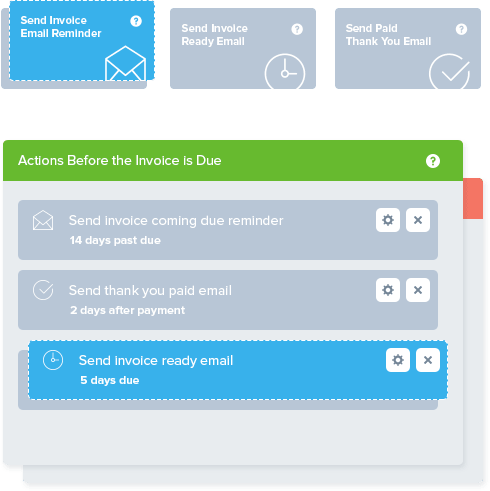

Broken integrations hurt more than your back office, they hurt your customers. Modern commercial clients expect self-service portals, automated updates, and seamless payment processing. If your data is scattered across systems, you can’t deliver that professional, transparent experience.

The ServiceTrade Difference

ServiceTrade’s QuickBooks integrations are different. They aren’t a clunky connector, they are integrations refined over 13+ years.

- No Hidden Fees: Unlike ERP connectors that cost thousands annually, ServiceTrade includes QuickBooks integration at no extra cost.

- Clean, One-Way Data Flow: ServiceTrade is your system of record for operations, QuickBooks for accounting—no duplicates, no chaos.

- Flexible Configuration: Five or six options for mapping customers, jobs, and locations so the system adapts to your business.

The Bottom Line

Every day you operate with broken accounting integrations, you’re losing time, money, and opportunities. Contractors using ServiceTrade eliminate the reconciliation nightmare, reduce manual entry, and regain confidence in their data.

The question isn’t whether you can afford to fix your integration problem. It’s whether you can afford not to.

Ready to Fix Your Integration Headaches?

If you’re using QuickBooks Desktop or QuickBooks Online and looking for the right field service management software to grow your business—streamline operations, maximize technician productivity, and improve profitability—reach out to us. Our team will walk you through ServiceTrade’s native QuickBooks integrations and proven implementation approach that gets contractors up and running fast. Don’t settle for startups, our contractors have been using this integration for over a decade successfully.