Category: Money for Nothing

That Awkward Moment

I love asking business owners and managers “Who do you think you are?” I’m not trying to pick a fight. What I’m really asking is “What makes you different and better than your competition?” But that’s a pretty boring question. Generally, those who give me a concise, thoughtful answer run growing and profitable companies. Those who can’t, don’t.

We’ve written a lot about figuring out what makes you different and better than your competition, but sometimes being committed to your unique value proposition leads to difficult conversations with customers and prospects. Being different will certainly help your company stand out relative to the competition, but it can also feel pretty uncomfortable at times. I will never forget a customer visit with Billy that illustrates just how difficult being committed to being different can be. We were visiting with Randy and Rebekah Akins, the owners of Aztec Fire and Safety in San Diego California. Randy was on the phone because he could not get to the office that day, and Billy, Rebekah, and I were sitting in Rebekah’s office. Randy led off the conversation with an observation on why he had abandoned his last customer service platform and selected ServiceTrade.

“The last application we used really screwed up our QuickBooks, and the most important thing ServiceTrade can get right is an elegant integration with our accounting application,” Randy declared through the phone speaker.

Uh oh, I thought to myself. This is about to get really interesting. Billy didn’t let it go as I hoped he might. Randy had just signed up with ServiceTrade the week before, and I guess Billy was pretty confident that Randy had already written and mailed the check because his first response was a verbal punch in the mouth for Randy.

“Well then, you are likely to be disappointed with ServiceTrade if an elegant QuickBooks integration is what is most important to you. We focus most of our research and development spending on innovations that help you make more money from your customers through great customer service. We believe making more money and great customer service is far more important than how you send the information to your accounting application.” Billy wasted no time getting to the heart of the conflict, and Rebekah and I stared awkwardly at each other wondering what was going to happen next. I personally was happy that Randy was not in the room because he seemed to be spoiling for a fight after wasting a year or more on an application and then switching to ServiceTrade to solve what he felt was his most important problem – QuickBooks integration.

My response to the situation.

“That’s a pretty arrogant thing to declare in the first meeting with a new customer. Basically, you are telling me that what I want is not important and that you guys know better than the customer. We are going to be very disappointed if you can’t help us with this QuickBooks problem.” Randy wasn’t backing down either. I felt I should do something, but this experience was like watching a train wreck, and I felt paralyzed. I literally couldn’t speak or move. Billy continued with “We certainly don’t mean to be arrogant, and you guys are important to us. I hope the QuickBooks thing works, but it might not. If you stick with us, however, I can promise you in six months you will be thrilled with how much easier it is to take care of your customers, deliver more services, raise your prices, and attract new customers.”

“We have already written the check, and we plan to make every attempt to be a good customer. I hope you are right because our last experience with technology was a huge disappointment,” Randy closed the door on the fight, and we moved onto more comfortable ground with a conversation regarding the training and data migration plan for Aztec.

Fast forward eight months and Billy and Randy are best buds. Randy and Rebekah’s business is growing like crazy, and they feel like ServiceTrade has made them stand out in their market. They are selling more services, earning a premium, and attracting new and better customers to their brand. Billy took a calculated risk in that first conversation because he knew that the best ServiceTrade could do regarding a QuickBooks integration was not going to impress anyone. QuickBooks is low cost, basic accounting application that is easy to use, but it has severe limitations regarding how third-party applications interface with it. There are no APIs for the desktop version. Besides, having a QuickBooks integration is not what sets ServiceTrade apart in the market. We know who we are as a company, and our mission is to help commercial service contractors use technology to deliver amazing customer service and become more valuable to their customers. QuickBooks has no bearing on that mission.

Do you know who you are as a business? Do you know what makes you different and special in your market? Can you confidently tell your prospects that you don’t care about being the low price leader and explain what unique value you can offer them instead? Can you explain why your program will reduce inconvenient and expensive breakdowns in the future? Do your customers know who you are? Commit to being different, even if it means being uncomfortable, in your early engagements with customers and prospects to overcome the bad habits they’ve learned from your low-end competition.

The Death of Blind Trust

Service contractors, beware. Blind trust is dead and as the “youths” say, pics or it didn’t happen. Pictures and videos are the new currency of trust thanks to technology that makes it so easy to capture and share them. Social media and modern ecommerce have trained us to expect images as tangible evidence that stories are true and products are real. Asking your customers to blindly trust your expertise without providing visual proof is like buying products online that don’t have pictures. It won’t happen. My wife and I had a recent experience with a Toyota dealership service department that’s a great example where a couple pictures could have made the difference between us being lifelong customers and abandoning the dealer completely.

When we purchased Jessie’s Prius, we bought a package of ten services at a discount from their counter rate. We drop her car off for service every few months and every once in a while they warn us about small issues like bad windshield wipers. Whenever possible, I take care of small issues myself. Changing out a set of wipers isn’t exactly rocket surgery.

We were satisfied with the Toyota dealer until last month when they performed a thorough inspection for the 75k mile service. That’s when the recommendations and repair suggestions came out of the woodwork! We expected some, but this list was just ridiculous. My favorite was that they still recommended new windshield wipers because they weren’t replaced by Toyota last time we brought the car in. They just carried the recommendation over despite the fact that there were obviously new wipers on the car. That particular misstep had me questioning the rest of the quoted work.

If they didn’t look at the wipers, how can we trust that they looked at anything else? There weren’t any pictures that prove that they did. They quoted us for tire alignment but they didn’t include a graph showing the results of the alignment test. They just said “Found suspension in need of alignment based on time or miles.” Then there’s the quote for replacing the brake pads and resurfacing the rotors without any pictures of the pad or rotor wear. The brake fluid is discolored? Show us. Pics or it didn’t happen.

We don’t like getting ripped off. Nobody does. Even the feeling that you might be getting ripped off is enough for someone to consider getting a second opinion. And, that’s exactly what we intend to do. We’re going to our favorite local mechanic who emails us pictures of issues before sending quotes for repair. Taking pictures and sharing them with your customers should be easy. If it’s not, you’ve got a problem. Don’t expect your customers to blindly trust you.

COUNT YOUR MnMs

“Money for Nothing” is the concept that you can charge a premium if you offer customers predictable facility outcomes at a predictable price. You should be more profitable when “nothing” happens: no emergencies and no system failures. These bad outcomes are undesirable for the customer and expensive for everyone, especially your company. Even if you charge the customer an exorbitant labor rate or emergency fee, being reactive costs a lot more than your tech’s overtime rate. The uneven labor demand of reactive work overextends your most expensive resource, skilled labor. Read our Money for Nothing blog post and check out Billy Marshall’s presentation, Money for Nothing: How Exceptional Service Brands Earn More Pay for Less Work, for a deeper understanding of the topic.

To understand how a Money for Nothing program works operationally, let’s talk about your technician Dan. OK, you may not have a Dan, but stick with me. Dan is the man. He’s been with you for years and he racks up all sorts of repair work and generates a lot of revenue for the business. He’s great at what he does and is irreplaceable in the face of the skilled labor shortage we’re experiencing. On a typical maintenance call, he may find a small equipment issue that has the potential of manifesting into a severe problem in the future. He reports the issue that makes its way to the customer as a quote. As usual, the facility manager, Stingy Steve, ignores the quote because he doesn’t think it’s all that urgent. Eventually, the equipment fails and Dan has to drop another job and work late to resolve the issue. Even though Dan the Man predicted the problem, Stingy Steve is still frustrated that he has to spend more money and deal with the hassle of an emergency.

That’s a bad customer outcome that could have been avoided. That’s how you lose customers. Dan did a great job reporting the problem and your team did a great job quoting it, but more effort should have been made to convince Steve that the minor repair was the right choice. Measuring the right performance metrics can help hold your team accountable for good outcomes and incentivize them to work harder for your customer to avoid situations like this.

Money for Nothing Metrics – or MnMs, not to be mistaken with M&Ms – are business measurements that will help your facility service organization effectively deliver on your premium service contracts and drive better customer outcomes. But first, what internal metrics do you currently use? Labor utilization summaries? Quote approval rates? Revenue per tech per day? These are valuable KPIs for measuring productivity and revenue, but what about customer outcomes? You can measure retention and customer lifetime value, but those are just the results of your performance. They indicate the overall “stickiness” of your brand and how effective you are at extracting dollars from your customers, but they don’t help you understand how you got there. We know that you can’t improve what you don’t measure, so let’s take a look at some key MnMs.

Suggested Repairs

How proactive is your team when it comes to equipment and system issues? Easy. Just track the ratio of reported, quoted, and approved proactive repairs as compared to more severe, reactive problems. The higher the ratio, the better job your company is doing at preventing future catastrophes. Even though these repairs produce less revenue, they will reduce the chance of a bad customer experience and can be scheduled during slow months.

Emergency Calls and Overtime Usage

How often do your customers have unexpected issues? For most service contractors, the answer is very seasonal, but you still have some control over the volume. More proactivity leads to fewer emergencies and happier customers. Measure the volume of emergency calls and overtime hours used for contracted customers to the total number of contracted customers by month to get a sense of what to expect from month to month. You know you’re doing a good job when that ratio drops for the same month year over year.

Hold your team accountable and incentivize them for “nothing.” Just like your program, your team should be making money for nothing: no emergencies, no failures, no bad outcomes. MnMs give you the numbers you need to set goals and realize outcomes.

Money for Nothing

When you deliver great service, equipment and systems don’t fail, nothing happens, and your customer is left wondering if you’re worth the money. When you deliver poor service, systems fail and the customer gets frustrated. You’re damned if you do and damned if you don’t. Billy Marshall’s keynote presentation at the 2017 Digital Wrap Conference, Money for Nothing: How Exceptional Service Brands Earn More Pay for Less Work, explains how to keep customers happy and earn a premium when nothing goes wrong. As Billy explained in an earlier blog post, this strategy requires you to show customers all the “snakes” you find in their systems:

You can give the customer what they want, which is nothing, as long as you are regularly finding snakes on the roof, snakes in the riser room, snakes in the ductwork, snakes in every nook and cranny of their critical equipment. Of course, these are figurative snakes, not literal snakes. The snakes are the equipment deficiencies that your technicians are recording with photos, audio, and video for the customer to review online via your Service Link. The deficiency snakes are clickbait that constantly reminds the customer how your diligence keeps them from getting bitten by disruptions and breakdowns which inevitably lead to hassles and aggravation.

Billy didn’t stop talking about snakes for months. He managed to take this snake analogy all the way to his keynote presentation:

The analogies and stories don’t stop at snakes. Check out Billy’s entire presentation to learn how to make “Money for Nothing” and create a customer program that will let you charge a premium because you provide more value.

Soon: The Smart Service Revolution

Predicting the future is tough, but predicting the future of customer service for commercial service contractors? That’s easy. The technology is already here. It’s already permeated the consumer world. It’s just a matter of time before it revolutionizes how you do business. Just like local retail was rocked by e-commerce and video rentals were decimated by online streaming, the way you deliver service and make customers happy is going to be upended in the next 5-10 years. Rest on your laurels and your brand will end up like Blockbuster. Prepare and, on the other side of this revolution, your company will emerge as a dominant brand like Amazon.

Three different technologies are going to drive the service contracting revolution: Smart cars, smart equipment, and smartphones.

Smart Cars

Every major car and truck manufacturer is developing some form of autonomous, self-driving vehicle. Imagine a fleet of driverless work trucks that are involved in a fraction of the traffic incidents and can deliver parts without wasting a tech’s billable time. That’s great! But, what happens to your company when nearly 5% of all workers in the national economy that drive for a living lose their jobs practically overnight?

When semi-trucks, delivery vans, and taxis don’t need drivers and all of those jobs disappear, the unskilled labor pool is going to overflow. With no new demand for unskilled labor and a massive increase in supply, economics tells us that the cost will go down. Hiring low-skilled workers is going to get cheaper and easier. This won’t solve the skilled labor shortage, but you will have a huge selection of candidates to fill entry-level and apprenticeship positions. Prepare for this labor glut by building an efficient job application review process and scalable training program for new employees, but don’t worry about their driving record.

If you’re an early adopter of a smart fleet, you’ll differentiate your brand and show customers how you take advantage of technology to reduce costs and provide better customer service, you’ll stand out from the competition. It’ll be part of selling the program. Driverless cars are a perfect fit for the program. They’ll enable your company to reduce costs for you and the customer while opening up productivity for improved customer service. Besides that, how cool do you think it will be to take your customers for a spin in one of your driverless trucks?

Driverless vehicles will be as transformative as the internet and successful service companies will adapt quickly. Just like the companies today that still use fax and paper to communicate instead of internet-enabled technologies, there will be Luddites and slow adopters of driverless cars. They will get left in the dust. Companies that are prepared will dominate.

Smart Equipment

Imagine building equipment smart enough to alert you when it needs maintenance or repair, all the while customers are paying you a recurring fee for “equipment monitoring.” You’ll be able to deliver exactly what the customer wants, optimal uptime, without the extraneous labor costs. In fact, it’s already on the market. However, manufacturers and building automation companies are fighting to lock everyone else out of the market. Whoever wins this fight will be positioned to own the relationship with the customer and levy a toll on anyone who wants access. What happens to your company if you’re on the wrong side of this toll?

If you don’t own the relationship with the customer, your brand will be devalued and you will become the truck depot beholden to a third party. Don’t get locked out of the revenue stream. Equipment monitoring products that bypass the building automation system are already on the market. From monitoring sprinkler flow for leak detection, to HVAC and chiller performance monitoring, you can track it all. The moment a problem occurs, you’ll be alerted and mobilize to save the customer’s day and prevent future mayhem.

But, there’s a catch. This future only exists if there is demand for standalone equipment monitoring products. Otherwise, the manufacturers and building automation companies, with their deep pockets, will push those companies out of the market or acquire them. The solution? Incorporate equipment monitoring in your premium program today! Go explore the market for the best monitoring solutions for your customers. They should have simple subscription pricing models with a API-enabled, cloud-based applications that feed equipment data directly to you and your customer. Treat it just like any other software purchase and refer to Chapter 9 of The Digital Wrap for buying criteria. Tell all of your colleagues at other service companies about the solutions you’ve found. Collaborate to find the best solutions and build demand in the market to avoid getting locked out.

Smartphones

Widespread smartphones adoption isn’t new, but its impact on your workforce and your relationship with customers is not done evolving. The average smartphone user spends 3-5 hours a day on their device. Those screens enhance almost every aspect of their lives except for how they do business with you. What happens to your company when they expect to engage with you through that screen? Will you be ready?

Trends in B2B tend to lag behind the consumer world by a few years, but they’re coming. Your customers will expect to engage with you entirely through their smartphones. The better their experience, the more valuable you’ll be. Easy said, hard done. Unlike banks and massive consumer brands like Amazon, you can’t afford or get away with a single shiny mobile app to manage all the communication. It’s too expensive and impersonal. You have a close relationship with your customers. You meet them in-person and chat with them on the phone all the time. Your solution to mobile engagement will require a multifaceted and integrated technology approach.

One way or another, you’re going to give your customers a branded mobile app. It will tell them everything they need to know about the work you do for them and give them a way to request and approve new work. While standing in front of a piece of equipment, they’ll have instant access to pictures, videos, and notes from every service you’ve performed on that asset. They’ll see a spend summary on the equipment and have the information they need to make a smart choice: repair, replace, or roll the dice. That information will roll up into an overall summary of their equipment so they can have their finger on the pulse of their facilities. All of these features will integrate seamlessly into their experience when they log in on their computer, just like ordering from Amazon or banking.

These future conveniences for you and your customers are coming. As we like to say, if you ain’t first, yer last. Be the leader in your market for adapting and adopting new ways of operating your service business.

How Valuable is Your Brand? Part 1

The following story is a preview from an upcoming book about how commercial service contractors can earn “money for nothing” by rethinking the way that they present and deliver the services that they provide their customers.

I am amazed at how often I see service contractors spending extraordinary effort to measure the gross margin of each service call, job, or project to two decimal places while simultaneously making zero effort whatsoever to measure and understand the value of their business in total. Service call gross margin is a very poor proxy measurement for the overall value of the business to its shareholders.

Any financial calculation of investment value is always about the current value of a future stream of income. The more certain and less volatile that future stream of income, the higher the premium that can be paid today to own that future income – i.e. to become a shareholder. For a service contractor, optimizing this value is all about having a large set of somewhat diverse customers that spend predictable amounts of money each year for the maintenance, monitoring, repair, and upfit of their important equipment. It is also about having a sales approach that regularly adds new customers to the portfolio while simultaneously having high customer satisfaction levels so that few customers ever terminate the relationship.

So what questions should you be asking as a shareholder to determine the value of a commercial service contracting business (or any other high value, maintenance or subscription-oriented business)? Here are a few ideas to get you started. Let’s see how you do in answering these:

- How many customers do you have under an annual or longer maintenance contract?

- What is the monthly recurring revenue (MRR) or annual recurring revenue (ARR) for the set of customers that have a maintenance contract?

- What is the total contract value (TCV) of future committed revenue for all customers under contract?

- What is the annual contract value (ACV) expected to become revenue in the next twelve months?

- What is the amount of deferred revenue on the balance sheet that reflects payments collected in advance for services to be delivered in the future? What is the ratio of this number to the ACV number above? To the TCV number above? The higher these ratios, the more committed the customers are to your contracts.

- What is the ratio of planned work revenue (maintenance, inspections, quoted repairs) to unplanned work revenue (emergency or priority service calls where something broke)? The higher this ratio the better the customer service being delivered. Customers do not like unplanned expenses nor the disruptions they represent.

- How much does it cost in sales and marketing expense to land a new customer (the cost to acquire a customer or CAC)? What is the ratio of that cost to the first year average revenue from a new customer?

- What is the net revenue churn in the customer base? How much revenue did you get this year from customers that have been with you for over a year relative to the revenue from those customers for the prior year? Minimal churn means your digital wrap is sticky.

- What is your contract renewal rate? What percentage of customers do not renew their maintenance plan when it comes due? How much annual contract revenue on average do these non-renewing customers represent? These numbers represent your gross churn.

All of these questions are directly correlated with the value of a service contracting business (or any subscription-oriented business for that matter), and not one of them deals directly with the question of gross margin for a service call. Service call gross margin is important, but gross margin on contract maintenance, inspections, and planned repairs is actually much more important. No investor will complain about an occasional expense hiccup for unplanned services in the context of a highly predictable stream of high margin, contract service fees. The very nature of unplanned work (it is unplanned!) makes it volatile and not particularly valuable to an investor.

So what is the formula for managing the business toward the highest return for the owners of the business? If service call gross margin is the wrong metric, what are the right metrics? And how can they be measured regularly to assure the business strategy is generating high shareholder returns?

As I indicated above, the basic finance formula for determining the value of an investment is to assess the amount and the risk of future income streams. Of course, predicting the future is tricky business, so it is best to rely on historical trends as a proxy for future performance, along with a healthy dose of common sense. With that in mind, I have developed a simple, easy to remember mantra for service contractors to keep in mind as they consider strategic initiatives to increase the value of the business:

How Many? How Much? How Long?

These three questions underpin the basic value-building fundamentals for almost any business.

A continuation of this chapter with tactical examples of how to measure “How many? How much? How long?” is included in our How Valuable Is Your Brand? Part 2.

You can also check out Billy’s previous post on this topic: What’s your company worth?

How Valuable is Your Brand? Part 2

As I indicated in my previous post, the basic finance formula for determining the value of an investment is to assess the amount and the risk of future income streams. Of course, predicting the future is tricky business, so it is best to rely on historical trends as a proxy for future performance, along with a healthy dose of common sense. With that in mind, I have developed a simple, easy to remember mantra for service contractors to keep in mind as they consider strategic initiatives to increase the value of the business:

How many? How much? How long?

These three questions underpin the basic value-building fundamentals for almost any business.

How many?

“How many?” refers to how many customers the business services under a contract. It can also be how many locations or customer assets are under contract. Likely all three need to be measured. Any business that is overly reliant on a small number of customers, even if they are large customers, has higher risks associated with their future income streams. A single screw up or a change in management at the customer can put the entire company at risk. It is better to have many customers with many locations so that the risk and volatility of the revenue portfolio are lower.

At the end of every quarter and every year, you should measure how many customers or locations were serviced that quarter compared to the same period in the prior year. Do you have more customers and locations under contract now? How many customers that were serviced last year declined service or canceled their contract this year? How many new customers were added under contract and serviced this year? As a percentage, what type of growth does this represent? How much did you spend on sales and marketing to add those new customers (sometimes this is difficult to measure precisely because marketing spending tends to come well ahead of actual customer wins, sometimes by several quarters or even years)?

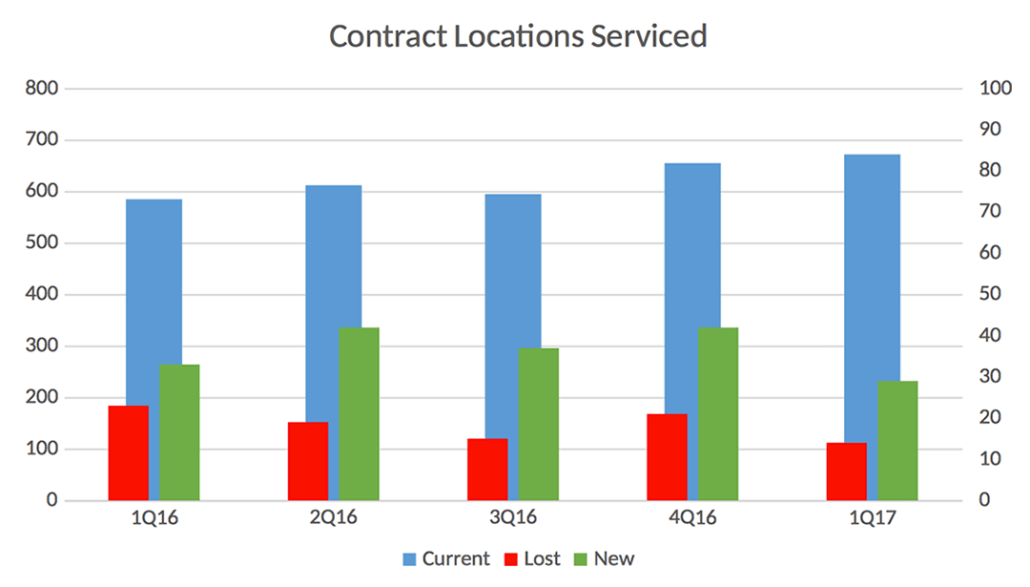

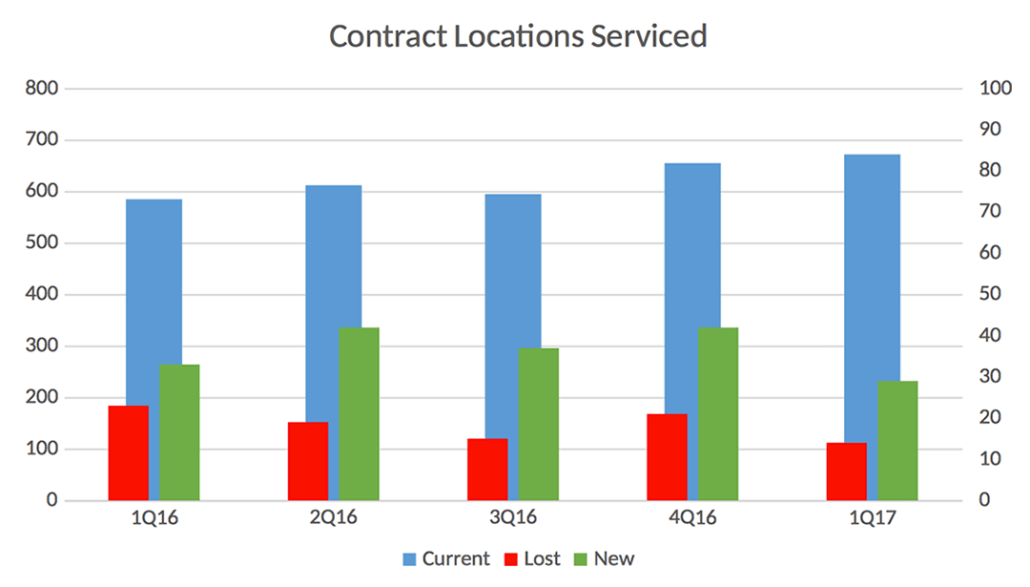

Here is my favorite chart for plotting the progress of the business in maximizing the how many? metric.

It shows the number of customers/locations serviced in the quarter, the number that declined service or canceled, and the number of new customers added. The customer locations lost and the newly added locations are plotted on the second axis because these may be small in a large, mature business with lots of customer locations under contract from years of servicing the market. Ideally, everything but locations lost is going up and to the right. The number of new customers/locations added should also exceed by a good margin the number that canceled. Otherwise, the “churn” in the customer base will eventually decimate your business if it continues over too many quarters.

How much?

“How much?” refers to the amount of revenue you can collect from a given customer or location. The higher the number the better, of course. There are generally two ways to drive this metric higher: 1) raise prices to charge more for what you do, and 2) do more for the customer. Investors love companies with pricing power in their markets. Companies that can raise prices without losing customers to the competition are valuable to shareholders. Customers love companies that can do more for them because their overhead associated with vendor administration is lower. It is also more difficult to replace a vendor that is doing many things, so your services are likely to be more durable in the face of a hiccup or challenging customer service situation.

Every quarter, you should measure the amount of revenue you earned from each customer and each group of customers relative to the amount of revenue you earned in the prior year period. Were you able to raise prices? Did customers respond to your solicitations for larger amounts of their business? Did they buy new innovations or suggested upgrades that you recommended?

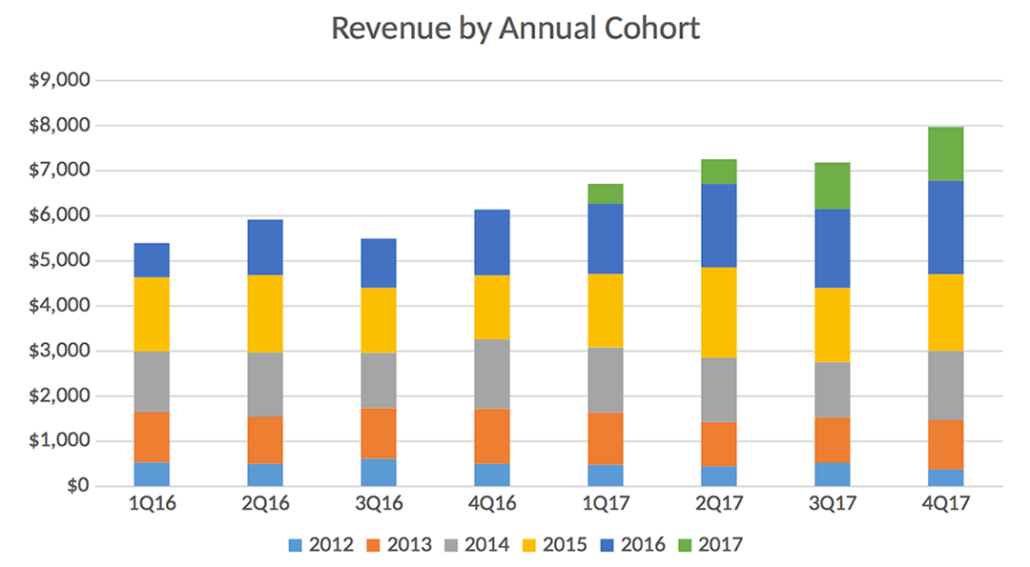

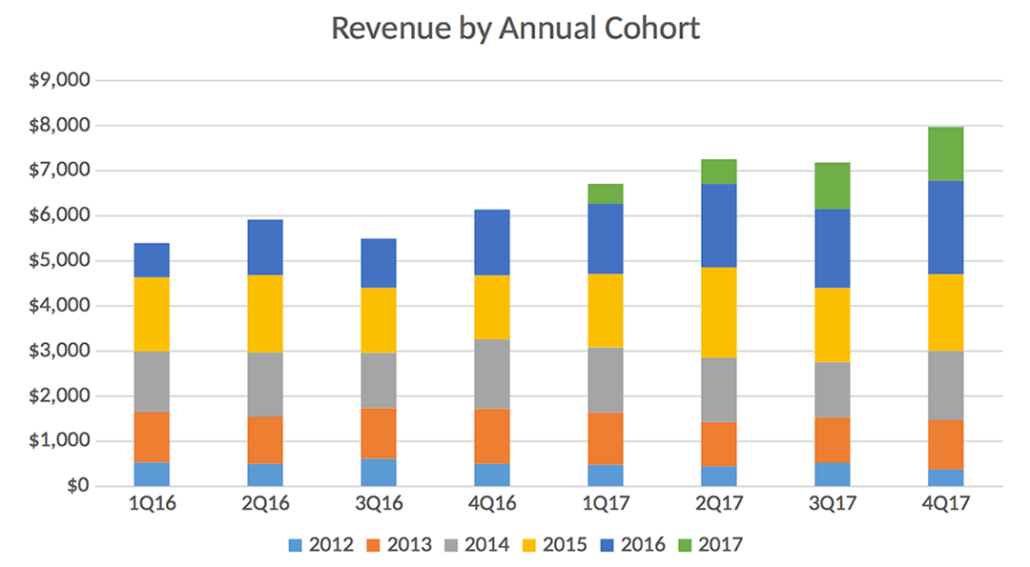

I suggest that you break your customers up into groups or “cohorts” indicating what year they initiated the service relationship with your company. You can plot a view of how much money you are getting each year from customers that have been with your company for one year, two years, three years, four years, and so forth and so on. Ideally, you are growing within each cohort group for the first few years and then holding onto most of that business during subsequent years. Some churn after a number of years is understandable as companies go out of business, merge and change strategies, or experience other corporate disruptions that ultimately affect their relationship with you. However, if you can show strong growth from sales to existing customers along with staying power within accounts as a business pattern, a new investor will pay you a premium for that trend.

Here is a chart that shows how revenue breaks down by customer cohorts grouped into the year you landed the service contract with the customer.

Notice how the recent cohorts start smaller, grow over time, and then hit a steady state before a slow decline.

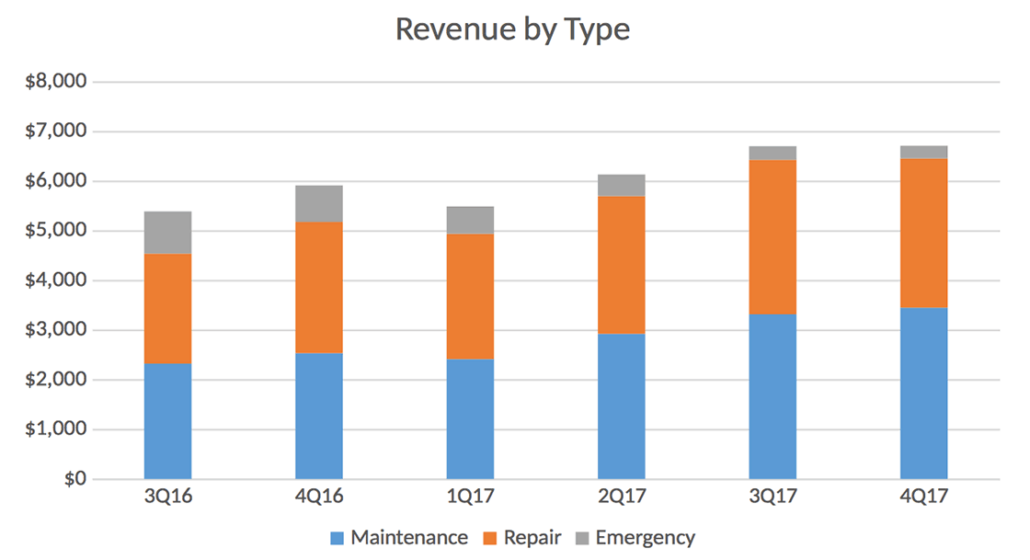

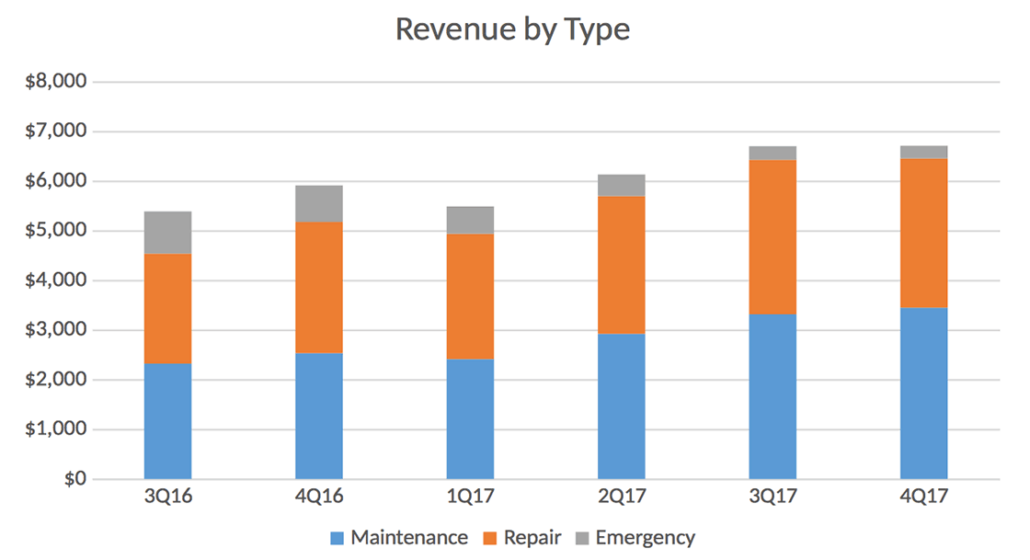

You should also measure how much? as a function of the type of revenue you are recognizing. I would suggest three different categories – contract maintenance or program subscription fees, planned repairs and upfits associated with quoted work, and unplanned repairs such as emergency service calls. You want to demonstrate a pattern over time of an ever increasing portion of your revenue coming from contract fees and planned work as compared with emergency service calls, which are typically associated with customer equipment malfunctions.

Planned work is more efficient and more scalable because the logistics can be meticulously coordinated. Customers benefit and your business benefits when you can plan the work to avoid excess travel time, expedited parts shipping, overtime expenses, and the general administrative stress associated with delivering service “right now.” Ideally, you can get the customers assets “under control” and minimize the service calls by quoting planned repairs to replace the risky equipment assets with more robust ones that are less prone to failure.

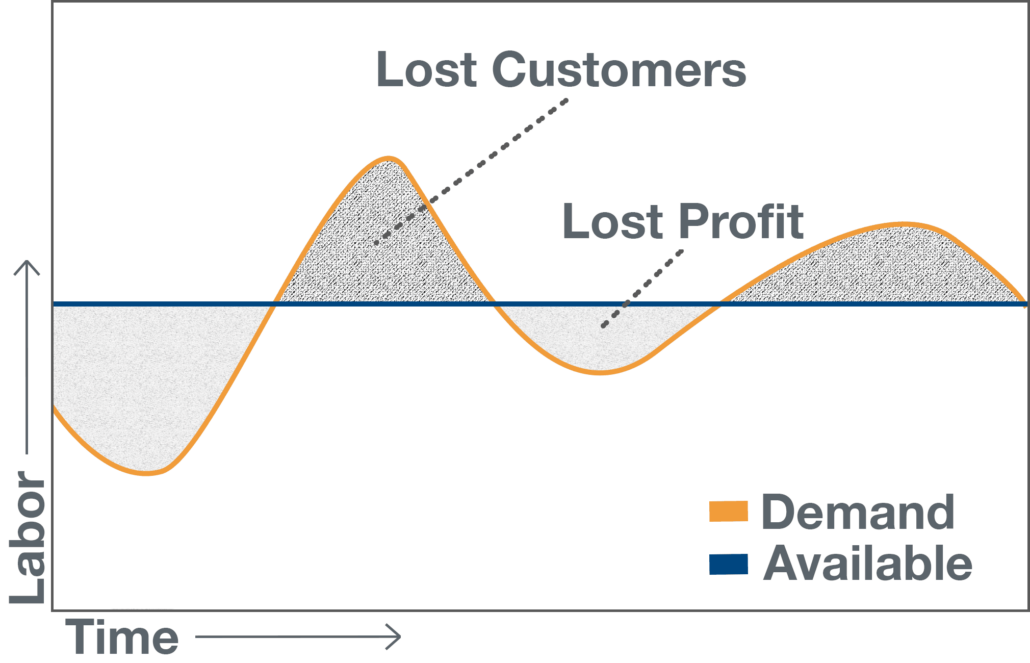

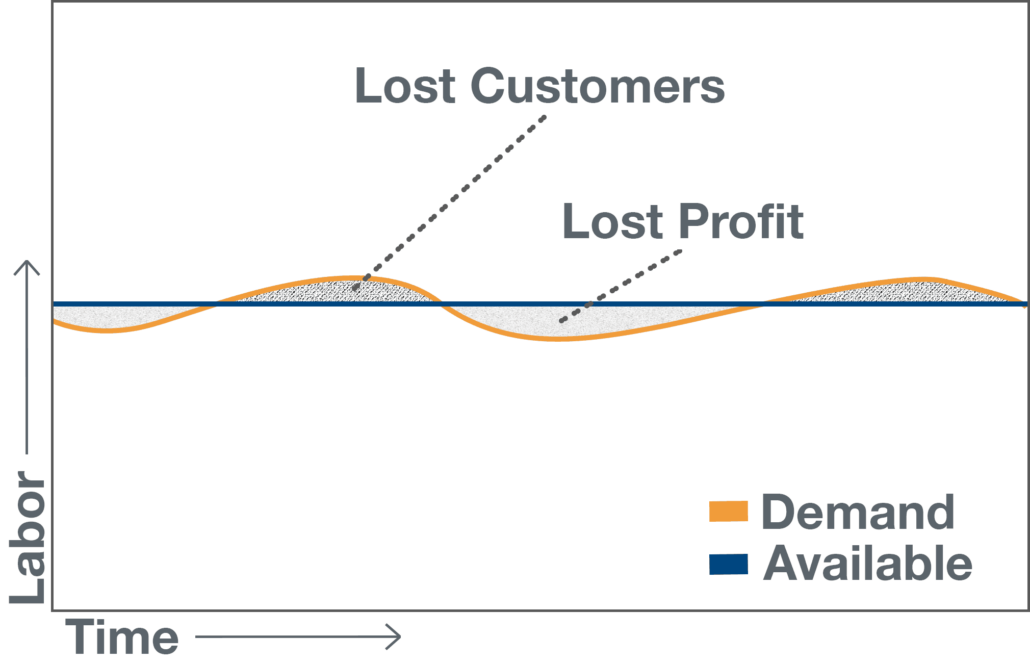

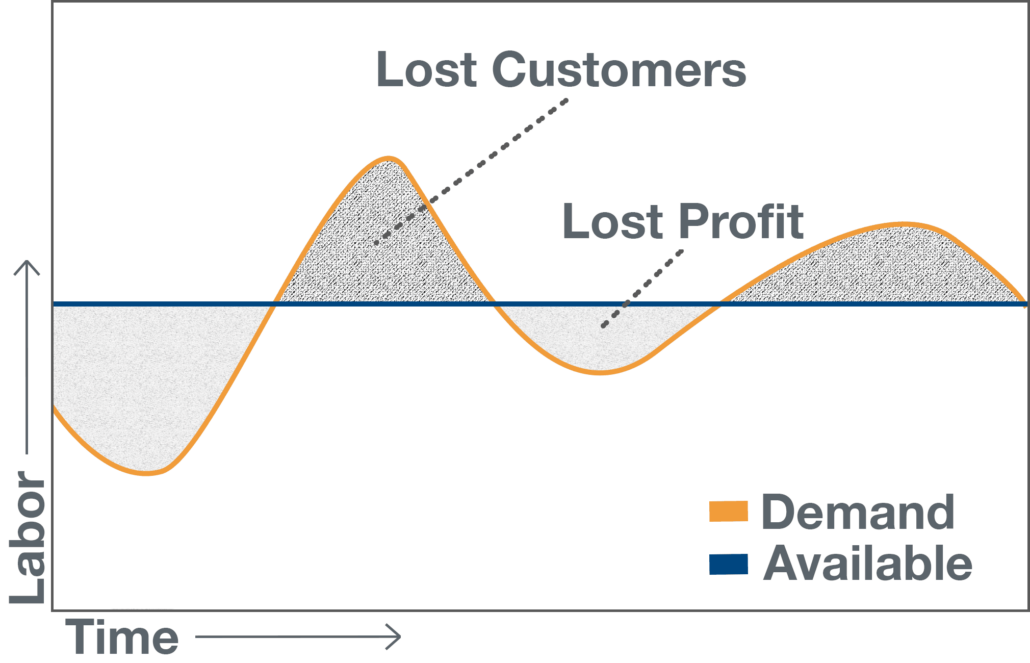

Here are a couple of graphic illustrations that demonstrate why you want to pursue a strategy that ultimately transitions your revenue mix from unplanned, service call work to programmatic contract work and quoted work.

The oscillating, sine-wave-shaped pattern represents demand associated with random equipment breakdowns when no programmatic approach is in effect across the customer base. If you scale up your technician workforce to deliver great service in the face of random peaks in demand, you will be losing lots of money as you keep that workforce in place during the random slack periods.

If you scale back your technician workforce to avoid the plunge in profits when demand tapers, you are at risk of delivering poor customer service during the peak periods.

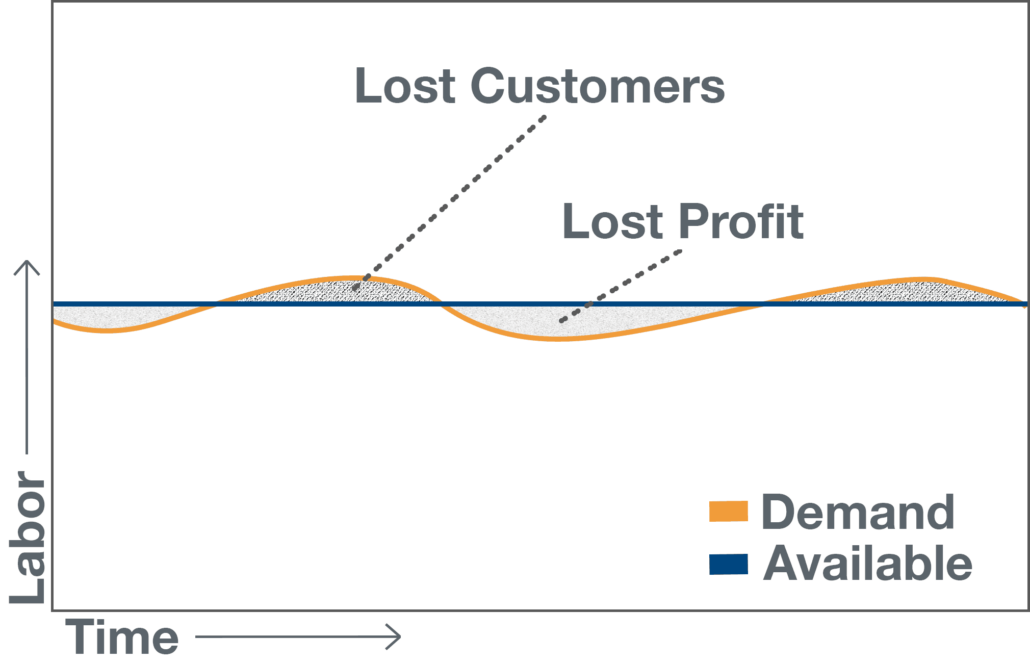

The ideal situation is to get the customer demand curve “under control” on a customer by customer basis by putting them into a contract that incents both you and them to programmatically eliminate the risks that ultimately drive equipment failure.

In this case, customers pay more for your maintenance program and monitoring fees, and in return, they have less risk of failure and fewer unplanned expenses. If you do a good job demonstrating to them the story of their equipment via video and photo evidence, they will not have a problem with the program fees, and they will generally accept your advice regarding repairs, retrofits, and upgrades that further eliminate risks, disruptions, and unplanned expenses. The ideal situation, as always, is that you are getting “money for nothing” while the customer sees daily evidence through your digital wrap that they are indeed paying for “something” very valuable.

How long?

In addition to measuring how many? and how much? on a periodic basis, you also need to measure how long? which refers to the duration of your relationship with a customer. If you can create a really sticky digital wrap that reinforces the story of your brand throughout the service cycle, you should, in theory, be able to hold onto those customers forever. Ideally, you are actively working your pricing model to manage your portfolio of customers by raising prices on those customers that do not fit with your model and in other cases perhaps trimming prices or offering other value-added services at a discount with those customers that are your prized possessions. In fact, once you become comfortable in your marketing and sales strategy and the cost of attracting new customers that fit the model, you will probably begin actively firing customers that do not fit by not renewing their contracts or simply directing them to your competitors when they call for service.

Investors love sticky brands with repeat customers that pay up year after year on a subscription basis to continue receiving the terrific results from the relationship. However, investors are just like customers in that they generally do not want to pay for nothing. In this case, nothing refers to sales pitch platitudes that ultimately add up to “Trust me! It’s gonna be great! Just sign the check so I can cash it!” You have to provide the evidence that your “money for nothing” program really yields higher returns in the form of a predictable income stream. Show them the charts that you use to measure the business value you are generating. I bet they are impressed, and you might be surprised at just how much “money for nothing” you get if you ever decide to sell shares in your company.

The bar graphs in this post were created from data in ServiceTrade with Amazon QuickSight. Learn more about how you can use this Business Analytics tool to uncover insights in your own service data.

A Story of Growth – AAA Fire Protection, Seattle

“When we started with ServiceTrade we had one pipefitter. Now we have five.” When Mary Krinbring of AAA Fire Protection in Seattle told us that in September 2015, everyone on our end of the phone’s eyes opened wide at that 500% growth. “Tell us more, Mary…”

Mary Krinbring, AAA Fire Protection. November 2017.

When AAA Fire Protection joined ServiceTrade in August 2014 they were bogged down with paper processes and wanted to go digital. They adopted ServiceTrade to speed up the time it took to send Invoices to customers.

Mary told us that they didn’t use ServiceTrade for quoting at first because they felt like they had it covered. But after learning how ServiceTrade’s built-in quoting could help them turn regular inspections into more repair jobs, they gave it a try. Mary attributes their need for more pipefitters to the nice workflow that converts deficiencies into quotes for repairs. Before long, they were having a hard time keeping up with their repair opportunities and added an estimator to create repair quotes for their expanded pipefitting team. Mary reports that using ServiceTrade has increased their quote volume by at least 50%.

Today, AAA’s pipefitting department has more than doubled again and the company has achieved 20% growth. Mary sat down with us at the 2017 Digital Wrap Conference to explain why she thinks that ServiceTrade and a Digital Wrap helped AAA break through barriers that were holding them back from reaching the growth they’d been working hard to achieve.

AAA Fire Protection is dedicated to smart growth and using technology to keep their customers around. ServiceTrade is proud to be their partner.